Schloss Bangalore IPO Allotment

Schloss Bangalore IPO Allotment Status: Allotment Out

The Schloss Bangalore IPO Allotment Status is Allotment Out and out on 29 May 2025 at 9:00 PM on the KfinTech Portal. Schloss Bangalore IPO bidding started on 26 May 2025 and closed on 28 May 2025 at 3:15 PM. Shares of Schloss Bangalore IPO are subscribed 4.72 times as of closing date. These shares got listed on BSE, NSE on 2 Jun 2025 at 9:15 AM. On BSE, listed at ₹406.50 at a discount of -6.55%. On NSE, listed at ₹406.00 at a discount of -6.67%.

Schloss Bangalore IPO is a Book Building issue of ₹3500 Crore, offering about 8.04 Crore to the public.

The offer is a combination of Fresh Issue of 5.74 Crore shares worth ₹2500 Crore and an Offer for Sale of 2.29 Crore shares worth ₹1000 Crore by its promoters. Promoters of Schloss Bangalore Limited are Project Ballet Bangalore Holdings (DIFC) Pvt Ltd, BSREP III Joy (Two) Holdings (DIFC) Limited, BSREP III Tadoba Holdings (DIFC) Pvt Ltd, Project Ballet Chennai Holdings (DIFC) Pvt Ltd, Project Ballet Gandhinagar Holdings (DIFC) Pvt Ltd, Project Ballet HMA Holdings (DIFC) Pvt Ltd, Project Ballet Udaipur Holdings (DIFC) Pvt Ltd.

10% of the issue is reserved for retail investors, 15% for NIIs, 30% for QIBs, and 50% of shares were reserved for anchor investors and their bidding date is 23 May 2025.

Retail portion is Undersubscribed 0.87x, NIIs portion is Oversubscribed 1.08x, QIB portion is Highly Oversubscribed 7.82x. Based on Schloss Bangalore IPO subscription rate and demand, investors may expect the following allotment success: 100% of Retail Investors are allotted successfully; NIIs may get 92.59%; QIBs may get 12.79%.

| Application | Allotment Probability | Min Shares | Min Amount |

|---|---|---|---|

| Retail Minimum | 100% of Applicants | 34 | ₹14790 |

| Retail Maximum | 100% of Applicants | 442 | ₹192270 |

| SHNI Minimum | 92.59% of Shares applied | 440 | ₹191716 |

| SHNI Maximum | 92.59% of Shares applied | 1038 | ₹452181 |

| BHNI Minimum | 92.59% of Shares applied | 1070 | ₹465209 |

| BHNI Maximum | 92.59% of Shares applied | 2109 | ₹917502 |

| QIB Minimum | 12.79% of Shares applied | 295 | ₹128631 |

Schloss Bangalore IPO Allotment Direct Links to Check Status

As of today, Schloss Bangalore IPO Allotment Status is "Allotment Out". Check allotment status using the direct links below:

| Check at | Allotment Status | Link |

|---|---|---|

| KfinTech | Allotment Out | KfinTech |

| BSE | Allotment Out | BSE Link |

| NSE | Allotment Out | NSE Link |

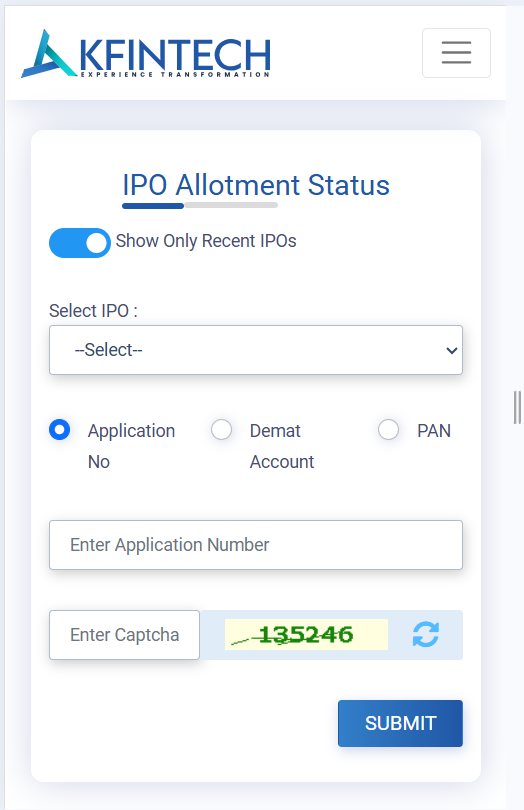

1. Steps to Check Schloss Bangalore IPO Allotment Status at KfinTech

- For checking the Schloss Bangalore IPO Allotment at KfinTech, please have your PAN number or IPO application number ready.

- Then click on KfinTech and you’ll see a page like the one above.

- Click on the “Select IPO” field and choose your issue from the list of recent IPOs with KfinTech as registrar.

- Select “SCHLOSS BANGALORE LIMITED” from the dropdown.

-

You can either use your PAN number or your IPO application number to check your allotment status:

- Select “PAN” and enter your 10-digit PAN in the “Enter PAN Number” field.

- Select “Application No” and enter your IPO application number in the “Enter Application Number” field (available from your broker platform).

- Enter the Captcha and click “Submit”.

- After 5–10 seconds, your Schloss Bangalore IPO Allotment Status will appear—verify by checking your Name and PAN.

- You can also see the number of shares you applied for and the number allotted to your application.

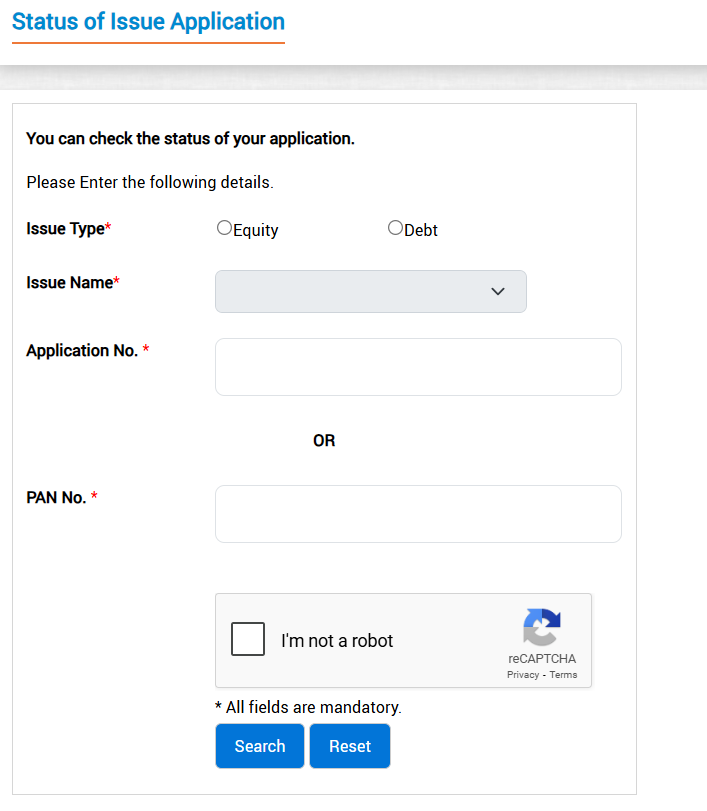

2. Steps to Check Schloss Bangalore IPO Allotment Status at BSE

- For checking the Schloss Bangalore IPO Allotment at BSE, please get your PAN number or your IPO Application number.

- Then, click on BSE Allotment and you’ll see a page as shown above.

- Click on “Equity” and wait for it to reload.

- Click on the “Issue Name” dropdown and select “SCHLOSS BANGALORE LIMITED” from the list.

-

You can either use your PAN number or your IPO application number to check your allotment status:

- For checking using PAN, select “PAN” and enter your 10-digit PAN number in the “Enter PAN Number” field.

- For checking using IPO Application number, select “Application No” and enter your application number in the “Enter Application Number” field (you can get it from your broker platform).

- Then enter the Captcha and click “Submit”.

- Once submitted, wait a few seconds for your allotment status to load.

- After 5–10 seconds, your Schloss Bangalore IPO Allotment status will be shown—verify by checking your Name and PAN.

- You can also check the number of shares you applied for and the number of shares allotted to your application.

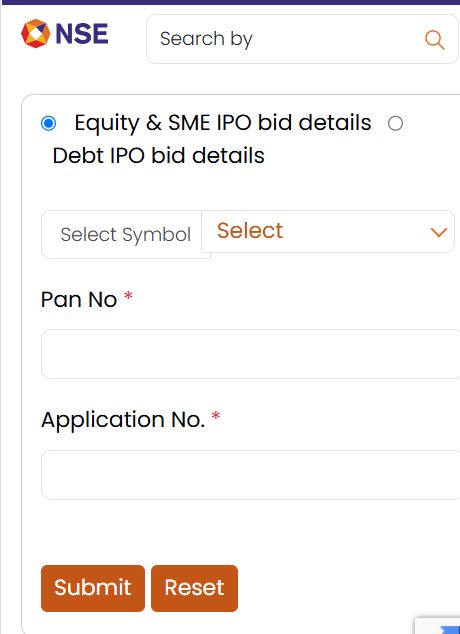

3. Steps to Check Schloss Bangalore IPO Allotment Status at NSE

- For checking the Schloss Bangalore IPO Allotment at NSE, please get your PAN number and IPO application number.

- Then, click on NSE Allotment and you’ll see a page as shown above.

- Click on “Equity and SME IPO bid Details”.

- Click on the “Select Symbol” dropdown and select the symbol for “SCHLOSS BANGALORE LIMITED” from the list.

- You should enter both your PAN number and IPO application number to check your allotment status.

- Once submitted, wait a few seconds as the page may be busy retrieving your allotment status.

- After 5–10 seconds, your Schloss Bangalore IPO Allotment status will appear—verify by checking your Name and PAN details.

- You can also check the number of shares you applied for and the number of shares allotted to your application.

Schloss Bangalore Limited IPO (Schloss Bangalore IPO) Overview

| IPO Name | Schloss Bangalore Limited IPO |

| IPO Status | Listed at BSE, NSE at INR 406 (-6.67% Loss) |

| IPO Open Date | 26 May 2025 |

| IPO Close Date | 28 May 2025 |

| Face Value | ₹10 Per Equity Share |

| One Lot Size | 34 Equity Shares |

| Total Issue | 8,04,59,769 Shares (worth up to ₹3500 Crore Rs) |

| Fresh Issue | 5,74,71,264 Shares (worth up to ₹2500 Crore Rs) |

| Offer of Sale | 2,29,88,505 Shares (worth up to ₹1000 Crore Rs) |

| Issue Type | Book Building Issue |

| IPO Listing | BSE, NSE |

| Retail Portion | Up to 10% of Net Issue |

| NII Portion | Up to 15% of Net Issue |

| Net QIB Portion | Up to 30% of Net Issue |

| Anchor Portion | Up to 50% of Net Issue |

| DRHP Draft Prospectus | View DRHP |

| RHP Draft Prospectus | View RHP |

| Anchor Investors List | View List |

Schloss Bangalore IPO Important Dates

The following table gives all important events and their timelines for Schloss Bangalore IPO.

| Anchor Investors Bid Date | 23 May 2025 |

| IPO Open Date | 26 May 2025 |

| IPO Close Date and Time | 28 May 2025 at 3:15 PM |

| Basis of Allotment | 29 May 2025 at 9:00 PM |

| Refunds | 30 May 2025 |

| Credit to DEMAT | 30 May 2025 |

| IPO Listing Date | 2 Jun 2025 |

Schloss Bangalore IPO Allotment Status FAQs

1. When is Schloss Bangalore IPO Allotment Date?

Schloss Bangalore IPO Allotment Date is 29 May 2025.

2. When is Schloss Bangalore IPO Refund Date?

Schloss Bangalore IPO Refund Date is 30 May 2025.

4. What is the current Schloss Bangalore IPO Allotment Status?

As of 29 May 2025, Schloss Bangalore IPO Allotment is Allotment Out.

5. How to check Schloss Bangalore IPO Allotment Status?

Check the Schloss Bangalore IPO Allotment status using the direct links below: